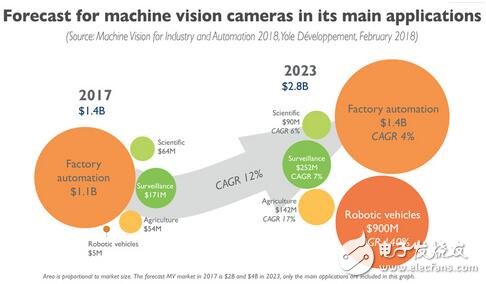

Memes Consulting: Machine Vision (MV) is at the heart of this automation revolution. The machine vision camera market will grow from $2 billion in 2017 to around $4 billion in 2023, with a compound annual growth rate (CAGR) of 12%. Automation is not limited to robotics, but it also involves almost all machines in the manufacturing cycle.

Machine vision is the core of the automation revolution

There is a quiet revolution in the factory. The forces of change we face are similar to those that occurred during the previous Industrial Revolution, but the forces of change are not steam or electricity-related technologies. Today's trends are autonomy and on-demand production, both for humans and machines. The transformation and upgrading within the factory is derived from automation related technologies.

Machine Vision (MV) is at the heart of this automation revolution. The machine vision camera market will grow from $2 billion in 2017 to around $4 billion in 2023, with a compound annual growth rate (CAGR) of 12%. Automation is not limited to robotics, but it also involves almost all machines in the manufacturing cycle. The demand for quality has contributed to the development of machine vision in the automotive, electronics, semiconductor, food and packaging industries. Food sorting is an interesting example of driving automation. Overall, the ability to sort fruits and foods helps increase the revenue of agri-food, especially in the Asian market. In fact, machine vision has “flyed†the factory and emerged in a variety of environments, including farms, pastures, roads and parking lots (such as license plate recognition). Recently, the hottest machine vision in the capital market is not autonomous vehicles. Yole expects the machine vision segment to grow at a compound annual growth rate of 140% in the next five years.

Main application areas and market forecasts for machine vision cameras

As mentioned in our previous report, the Swatch Group announced in 2014 the launch of the Sistem51 series of watches, a fully automated mechanical watch. Since then, other companies have taken similar steps, such as Canon's introduction of automation in camera manufacturing and Foxconn's deployment of one million robots in consumer electronics manufacturing. As a result, the sales growth of automation products exceeds the growth rate of industrial production. Looking ahead, this trend of automated production may accelerate as the cheap labor in Western countries is in short supply and the wages of workers in China are also growing.

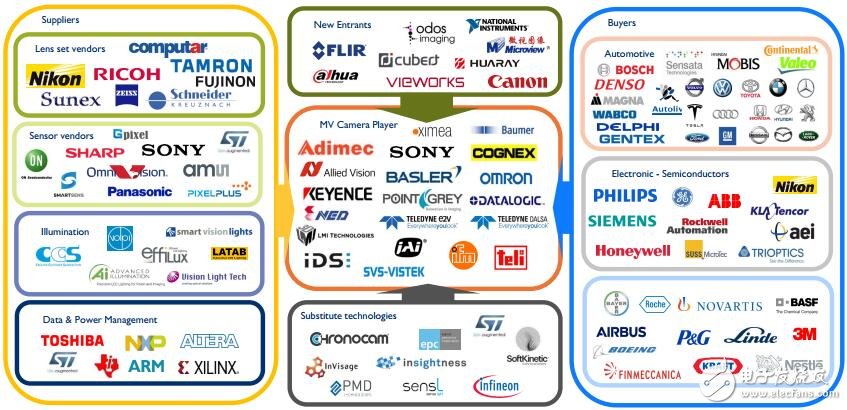

Highly active market and vendor ecosystem

The automation revolution has created a highly active market and vendor ecosystem. In the three years from 2014 to 2017, M&A activities accelerated at the image sensor and camera module levels. The latest example of this trend is that FLIR acquired Pointgrey for $215 million in 2016 and Teledyne acquired e2v for $790 million in 2017. Other notable acquisitions include: 2016 ams acquired CMOSIS for $235 million; in 2014, ON Semiconductor consolidated ApTIna for $400 million and acquired Truesense for $90 million. Recently, private equity firm Lakesight has integrated machine vision camera manufacturers TatTIle, Microtron and Chromasens. According to estimates by Maers Consulting, the total amount of mergers and acquisitions during this period was more than $1.7 billion.

The competitive landscape of machine vision industry chain manufacturers

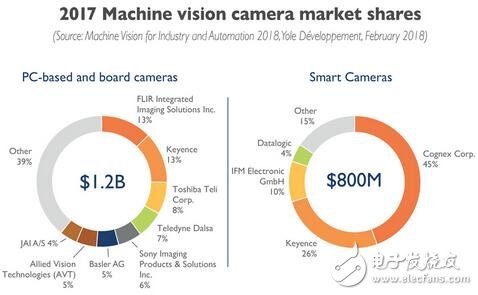

Market share of machine vision camera manufacturers in 2017

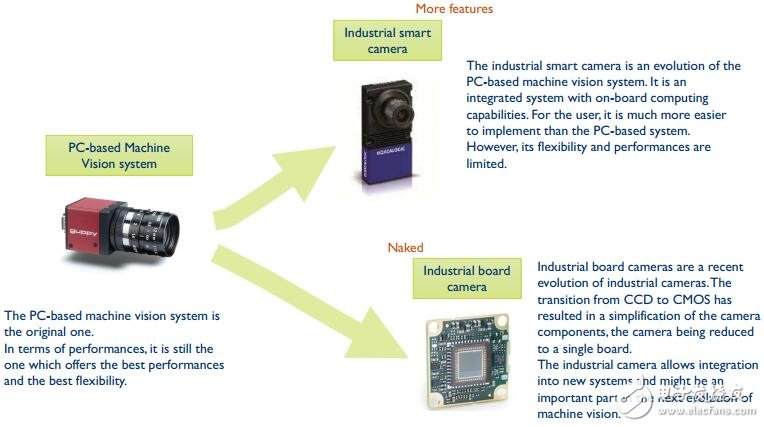

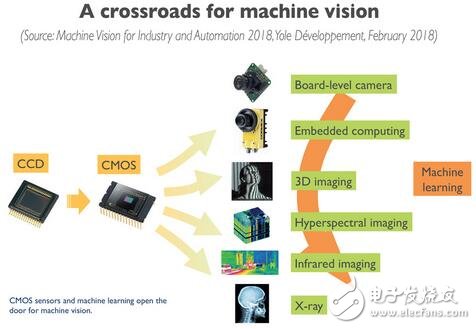

The transition from charge-coupled devices (CCDs) to complementary metal-oxide-semiconductors (CMOSs) has had a profound impact on machine vision image sensors, setting off the wave of mergers and acquisitions. Although this has affected other markets many years ago, such as consumer image sensors in the 1990s and photographic sensors in the early 21st century, until now, the technological shift from CCD to CMOS has hit the peak of the image sensor market.

Companies that sell “high cost/small lot†products cannot invest in or maintain production facilities. Due to the high fixed investment in the construction of production facilities, high-yield product support is required. And compared to the previous vertically integrated CCD manufacturers, the entry cost of implementing CMOS image sensor manufacturing is higher. Therefore, in addition to Sony, many manufacturers have turned to the Fabless business model. This has also led to the rise of CMOS image sensor-specific foundries such as TPSCo, Dongbu Hitek and SMIC, which acquired LFoundry.

From CCD to CMOS: major changes in the camera module level that may lead to new manufacturers

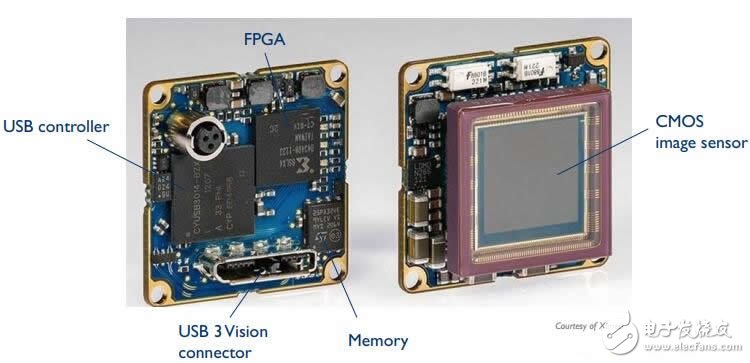

On the technical side, the transition of image sensors from CCD to CMOS greatly simplifies camera design and is easier to commercialize. Integrating camera functionality into a CMOS image sensor also results in the camera being implemented with a single board. This single-board camera, in turn, affects the supply chain and enhances the position of machine vision camera manufacturers. Therefore, we can see emerging camera manufacturers integrating these single-board cameras into new systems, new applications and smart cameras.

Note: In CCD applications, most of the functions are performed on the camera's board. When the application needs to be modified, the designer can modify the board level circuit without having to redesign the image sensor chip. In a CMOS image sensor, the operation of converting a charge into a voltage is performed on each pixel. CMOS image sensor chips convert charge to voltage at the pixel level, and most of the functionality is integrated into the chip. In this way, all functions can be operated from a single power source, and the image can be flexibly read out according to the region of interest or window opening. In general, CCDs use NMOS technology to achieve performance through specific processes such as double-layer polysilicon, AnTI-blooming, metal shielding, and specific starting materials covering each other. CMOS is based on the standard CMOS process technology of integrated circuits, and then added imaging functions according to customer requirements.

The integration of camera modules into systems and smart cameras is also driven by smartphone technology. System-on-a-chip (SoC) and Mobile Industry Processor Interface (MIPI) make it easier to develop intelligent vision systems. An example of a popular smart camera is Specim's recently released multispectral camera product.

Machine Learning (ML) is an important technology that enables smart cameras to be widely used. For example, in 2017 Cognex acquired Vidi Systems, a deep learning software company, to apply deep learning to smart cameras. Technologies such as machine vision and deep learning will have an important impact on autonomous vehicles and drive the rapid growth of relevant markets. It is estimated that by 2023, the market for machine vision cameras in the field of self-driving cars will exceed $900 million, accounting for a quarter of the entire machine vision camera market.

ZGAR AZ CC Disposable

ZGAR electronic cigarette uses high-tech R&D, food grade disposable pod device and high-quality raw material. All package designs are Original IP. Our designer team is from Hong Kong. We have very high requirements for product quality, flavors taste and packaging design. The E-liquid is imported, materials are food grade, and assembly plant is medical-grade dust-free workshops.

Our products include disposable e-cigarettes, rechargeable e-cigarettes, rechargreable disposable vape pen, and various of flavors of cigarette cartridges. From 600puffs to 5000puffs, ZGAR bar Disposable offer high-tech R&D, E-cigarette improves battery capacity, We offer various of flavors and support customization. And printing designs can be customized. We have our own professional team and competitive quotations for any OEM or ODM works.

We supply OEM rechargeable disposable vape pen,OEM disposable electronic cigarette,ODM disposable vape pen,ODM disposable electronic cigarette,OEM/ODM vape pen e-cigarette,OEM/ODM atomizer device.

ZGAR AZ CC Vape,ZGAR AZ CC Vape disposable electronic cigarette,ZGAR AZ CC Vape vape pen atomizer , AZ CC E-cig,AZ CC disposable electronic cigarette

ZGAR INTERNATIONAL(HK)CO., LIMITED , https://www.szdisposable-vape.com